What you need to know ahead of the Fed!

Markets jitter ahead of the Fed policy meeting decision today, with Asian stocks ending the session mixed after an intensely volatile Wall Street session. With Expectations pointing heavily to a hawkish fed and the like hood of Jerome Powell stressing on higher inflation and a March hike rate, which is kind of already priced in however since markets have been down a rollercoaster this past week, investors remain worried about what he has to say especially with chances of aggressive tightening as well.

The first Fed meeting of the year comes at a difficult time for the stock market as they get affected by geopolitical woes. As Russian troops at the Ukraine border send an even more cautious sentiment amongst traders.

Overnight, The S&P reversed earlier gains ending the session at the lowest level since October 2021 and the Nasdaq too ended up with a steep loss of -315.83 points. Both reversing Tuesday's abrupt gains after the S&P had dropped 10% only to make a U-turn at the last 10 minutes of the session.

.png)

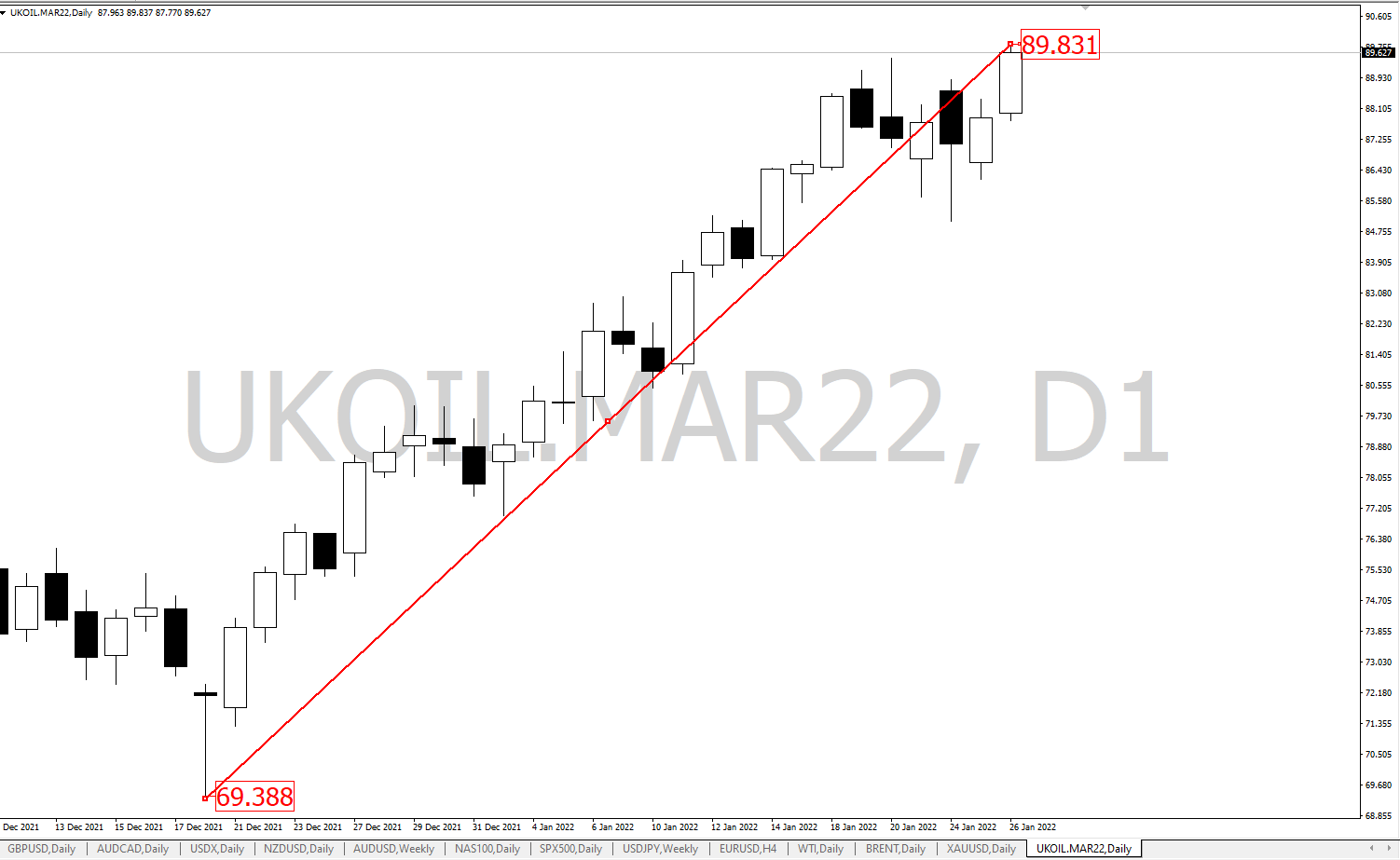

In Commodities, Oil traders focus on crude stockpile draws and Eastern Europe tensions. Supply tensions pushed oil prices higher by 2%. And at the opening of the U.S. Session oil surpassed its highest-level hit since 2014 over further intensified tensions in the middle east and further supply disruptions. Brent crude futures rose to a peak near $90 (view the below chart) while WTI headed towards levels of $87.