U.S. Federal Reserve's chances of hiking interest rates by 75 bps fall

Investors see about a 40% chance of a third consecutive 75 basis point Fed rate hike in September, and expect rates to hit a peak around 3.7% by March, and to hover around there until later in 2023.

- The Federal Reserve is more advanced in its monetary tightening path, and minutes from the July Fed meeting, released on Wednesday, showed officials saw "little evidence" late last month that U.S. inflation pressures were easing.

- That said, they did flag an eventual slowdown in the pace of hikes, but not a switch to cuts in 2023 that had been the widely held belief prior to the minutes’ release. There still remains a great deal of uncertainty over the size of the interest rate hike when the Fed next meets in September, and this could keep markets in tight trading ranges ahead of next week’s central bankers get together at Jackson Hole.

Equities:

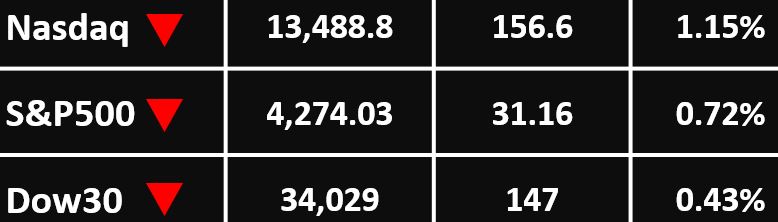

- In Wall Street, U.S. stocks closed lower on Wednesday, with indexes volatile after minutes from the Federal Reserve’s meeting in July suggested policymakers may be less aggressive than previously thought when they raise interest rates in September. Major indexes sharply cut their losses after the release of the minutes, with the Dow briefly turning positive, before they returned to earlier lower levels.

- The Dow Jones Industrial Average fell 147 points, or 0.43%, to 34,029, the S&P 500 lost 31.16 points, or 0.72%, to 4,274.03 and the Nasdaq Composite dropped 156.6 points, or 1.15%, to 13,488.8.

--------------------------------------------

Currency Market:

- The dollar climbed to a three-week high after minutes from the Federal Reserve's July meeting pointed to U.S. interest rates staying higher for longer to bring down inflation. This left the dollar index up 0.22% at 106.89, its highest since late July.

- GBP/USD was last down 0.3% at $1.2015, while the EURUSD shed 0.2% to $1.0157.the dollar climbed a touch on the yen to trade at 135.25 yen.

- AUDUSD fell to a one-week low of $0.6899, NZDUSD was also pinned to Wednesday lows and was last down 0.35% at $0.6258.

--------------------------------------------

Commodities: Gold

- Gold prices kept to a tight range amid mixed signals over U.S. monetary policy. Spot gold rose 0.2% to $1,767.65 an ounce, while gold futures rose 0.15% to $1,778.75. But both instruments were trading largely within a $1,750 to $1,810 range seen over the past two weeks.

- Gold prices had slipped on Wednesday after the minutes of the Federal Reserve’s July meeting showed that most members supported more rate hikes to bring down inflation.

--------------------------------------------

Commodities: Oil

- Oil prices were little changed on as investors grappled with falling stockpiles in the United States, rising output from Russia and worries about a potential global recession.

- Brent crude futures climbed 15 cents, or 0.2%, to $93.80 a barrel. WTI gained 4 cents, or 0.1%, to $88.15 a barrel.

ـــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــ

For more articles click here