Markets Await The Meeting of ECB this week

Markets focus move this week to the European Central Bank (ECB) meeting. ECB policymakers meeting on Thursday have a choice between a big 50 basis point interest rate hike, or an even bigger one to contain record high inflation.

- Investors have priced in a greater chance of a supersized 75 basis point move since last week's 9.1% record-high inflation figure and pressure is on the ECB to go hard now before economic conditions deteriorate and its room to tighten shrinks.

- A bigger move would show a determination to curb inflation running way above the ECB's 2% target and help bolster the bank's credibility. The ECB opted for a bigger-than-expected July move and other big central banks have hiked aggressively.

---------------------------------------------------

Equities:

- In Wall Street, U.S stocks closed out the trading week on a down note on Friday, although it opened sharply higher after the August U.S. payrolls report showed stronger-than-expected hiring but a climb in the unemployment rate to 3.7% eased some concerns about the Federal Reserve being overly aggressive in raising interest rates as it attempts to bring down high inflation.

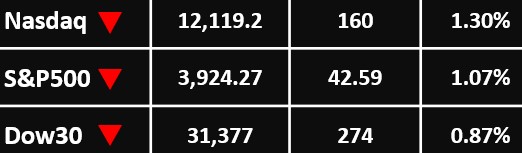

- Energy was the only major S&P sector to end the session in positive territory, up 1.81%. The Nasdaq Composite dropped 160 points or 1.30% to 12,119.2, while the S&P 500 lost 42.59 points or 1.07% to 3,924.27 and The Dow Jones Industrial Average fell 274 points or 0.87% to 31,377.

- U.S. markets are closed for a public holiday on Monday.

---------------------------------------------------

Currency Market:

- The U.S. dollar rose to a new two-decade high. The Dollar Index traded 0.5% higher to 110.020, having earlier climbed as higher at 110.255, the highest level in 20 years.

- EUR/USD slumped over 0.5% to 0.9897, dropping below 0.99 for the first time since 2002, after Russia decided to halt indefinitely the supply of gas down its main pipeline to Europe, sparking concerns over energy rationing when temperatures start to fall on the continent.

- GBP/USD fell 0.3% to 1.1474, also weighed down by rising energy costs. USD/JPY rose 0.2% to 140.45, remaining above the key 140 area.

- USD/CNY rose 0.5% to 6.9355.

---------------------------------------------------

Commodities: Gold

- Gold prices fell slightly on Monday, extending sharp declines from last week as strength in the dollar and growing uncertainty over hawkish U.S. monetary policy weighed on appetite for the yellow metal.

- Spot gold fell 0.2% to $1,707.69 an ounce, while gold futures fell nearly 0.1% to $1,721 an ounce.

---------------------------------------------------

Commodities: Oil

- Oil prices rose more than $2 a barrel on Monday, extending gains as investors eyed possible moves by (OPEC+) producers to cut output and support prices at a meeting later in the day.

- Brent crude futures had risen $2.42, or 2.6% to $95.44 a barrel. U.S. WTI crude futures was at $88.92 a barrel, up $2.05, or 2.4%.

---------------------------------------------------

For more articles click here