Investors may face fresh volatility in financial markets this week

After a week that saw financial markets rocked as central banks and governments ramped up their fight against inflation, investors will be bracing themselves for fresh volatility this week. Several Federal Reserve officials are due to speak, fresh off delivering their third straight 75 basis point rate hike with no let-up in sight.

- The highlight of the U.S. economic calendar will be Friday’s data on personal income and spending, which includes the Fed’s favored inflation gauge.

- Economic indicators from the Eurozone and the UK also showed a pronounced contraction in business activity, ramping up fears of a recession and denting the demand outlook for metal markets.

- Some major central banks are not able to cope with the Fed after FOMC had turned more hawkish last week, this is why the US dollar is soaring and continues to strengthen with the Dollar Index sitting at 114.40 its new 20-year high.

---------------------------------

Equities:

- Wall Street's main indexes suffered heavy losses last week with the Nasdaq dropping 5.03% - its second straight week falling by more than 5%, while the S&P 500 ended down 4.77% and the Dow shed 4%. The Dow only narrowly avoided joining the S&P 500 and the Nasdaq in a bear market.

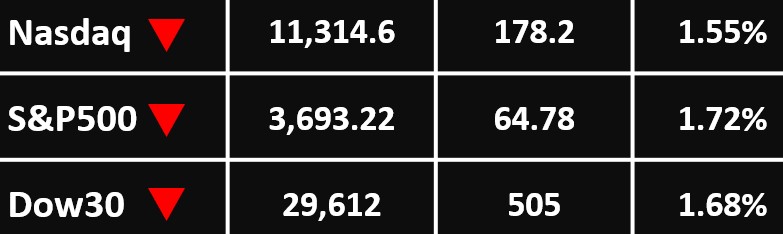

- Last Friday, the Nasdaq Composite dropped 178.2 points, or 1.55%, to 11,314.6, the S&P 500 lost 64.78 points, or 1.72%, to 3,693.22 and the Dow Jones Industrial Average fell 505 points, or 1.68%, to 29,612 points.

---------------------------------

Currency Market:

- The US Dollar Index gained 0.4% to 113.430. The euro was also hard hit, with EUR/USD trading 0.6% lower to 0.9632, after earlier falling to a fresh 20-year low below 0.96.

- GBP/USD slumped as much as 5% to an all-time low of 1.0327 earlier Monday, before stabilizing around 1.0714, 1.7% below the previous session's close.

- USD/JPY rose 0.4% to 143.86, with the yen slipping despite last week’s intervention by Japanese authorities to support the yen for the first time since 1998. AUD/USD fell 0.6% to 0.6491, and USD/CNY rose 0.5% to 7.1620.

---------------------------------

Commodities: Gold:

- Gold prices retreated further on Monday as the dollar notched a new 20-year high amid growing fears of rising interest rates and a potential economic recession.

- Spot gold was unchanged around $1,643.82 an ounce, while gold futures fell 0.3% to $1,651.30 an ounce.

---------------------------------

Commodities: Oil:

- Oil prices fell for a second day on fears of lower fuel demand from an expected global recession sparked by rising worldwide interest rates and as a surging U.S. dollar limits the ability of consumers to purchase crude.

- Brent crude slipped 1.57%, to $84.80 a barrel. WTI crude dropped 1.46%, to $77.59 a barrel.

--------------------------------------

For more articles click here