Investors look for clues about the central bank's policy outlook

Investors have spent much of this week anticipating Jackson Hole Symposium which has now officially begun. Of course, markets are all waiting for the remarks by Fed Jay Powell today.

- Markets have got some economic data that come along the way, but nobody can be sure how much the scheduled data can tell about the future performance of traded assets.

- Today, the core PCE which be released. This is Fed’s favorite inflation measure, the personal consumption expenditures index. Analysts expect core PCE to rise 4.7% from last year and 0.3% from the prior month.

- Most economists expect Jerome Powell to express insistence to continue to tighten financial conditions until inflation declines on a sustained basis two or three months.

---------------------------------------------------

Equities:

- Wall Street ended sharply higher on Thursday, lifted by gains in Nvidia and other technology-related stocks as investors focused on the Federal Reserve's Jackson Hole conference for clues about the central bank's policy outlook.

- Apple and Microsoft rose more than 1%, while Amazon and Google Alphabet added more than 2%, with all four companies making substantial contributions to the Nasdaq's increase. All 11 S&P 500 sector indexes rose, led by materials, up 2.26%, followed by a 2.06% gain in communication services.

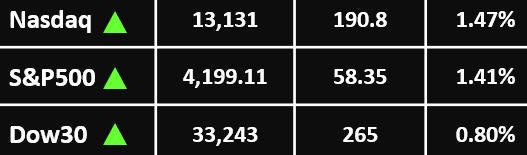

- The Nasdaq gained 1.47% to 13,131 points, The S&P 500 climbed 1.41% to end the session at 4,199.11 points, while the Dow Jones Industrial Average rose 0.80% to 33,243 points.

---------------------------------------------------

Currency Market:

- The U.S. dollar pushed higher ahead of Federal Reserve Chair Jerome Powell's eagerly-awaited speech at the central bank’s Jackson Hole gathering, which could provide more clues on future policy tightening.

- The Dollar Index traded 0.2% higher to 108.623, just below its highest level in two decades and on track for a 0.4% weekly gain.

- EUR/USD fell 0.2% to 0.9958, dropping back below parity as Europe’s energy crisis sapped confidence from German households.

- GBP/USD fell 0.3% to 1.1793, USD/JPY rose 0.4% to 137.01 as US Treasury yields rose ahead of Powell’s speech, while USD/CNY rose 0.2% to 6.8625.

---------------------------------------------------

Commodities: Gold

- Gold prices fell as traders awaited more cues on U.S. monetary policy from the Jackson Hole Symposium, but were set to end the week higher as the dollar retreated from 20-year peaks.

- Spot gold prices dropped 0.3% to $1,758.76 an ounce, while gold futures fell 0.2% to $1,767.70 an ounce snapping three straight days of gains.

---------------------------------------------------

Commodities: Oil

- Oil prices rose as much as $1 on signs of improving fuel demand, although further gains were capped as the market awaited clues from the U.S. Federal Reserve chairman on the outlook for rate hikes in a speech later in the day.

- Brent crude futures climbed 99 cents, or 1%, to $100.33 a barrel, while WTI crude futures rose 98 cents, or 1.1%, to $93.50.

---------------------------------------------------

For more articles click here