Investors hold their breath ahead of the US CPI on Wednesday

Investors hold their breath ahead of the US Consumer Price Index to be released on Wednesday. Concerns about economic growth and aggressive tightening in the US re-surged on Friday after a strong job report. Investors will make a reassessment of the situation after the release of inflation figures.

- The July CPI figure is expected to ease to 8.7% on an annual basis from 9.1% previously, but a New York Fed survey showed consumers' inflation expectations fell sharply in July, perhaps offering further downside potential to this figure. A large fall in the CPI release could provide sufficient evidence that inflation has peaked to persuade the Fed to relax its aggressive tightening path.

- The strong July U.S. jobs report increased expectations that the U.S. Federal Reserve will continue its aggressive monetary tightening with another hike of 75 basis points in September.

Equities:

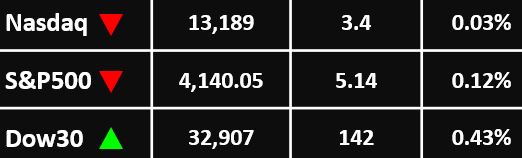

- In Wall Street, stocks were mostly flat on Monday, the dollar weakened and U.S. government bond yields fell as investors weighed mixed messages about inflation and how far point the Federal Reserve could be aggressive in combating it.

- The Dow Jones Industrial Average rose just 0.43% to close at 32,907 points, while the S&P 500 lost 0.12% at 4,140.05 points and the Nasdaq Composite fell 0.1% to 13,189 points. Of note is Nvidia Corp, whose shares fell about 6% after the chip designer warned on Monday that its second-quarter revenue would fall 19% from the previous quarter due to the weakness of its gaming.

-----------------------------------------

Currency Market:

- The Dollar Index traded 0.1% lower at 106, dropping further back from Friday’s peak of 106.93, the strongest level since July 28. Investors awaited US inflation data this week, as they fear a surprise may increase pressure to raise interest rates.

- EUR/USD rose 0.1% to 1.0206, USD/JPY fell 0.1% to 134.90, while the risk-sensitive AUD/USD fell 0.2% to 0.6976.

- GBP/USD rose 0.1% to 1.2086, with sterling traders focusing on Friday’s release of U.K. GDP for June. The Australian dollar held its gains at $0.6974. It is the same path as the New Zealand dollar, as it reached $0.6281.

-----------------------------------------

Commodities: Gold

- Gold prices held on to recent gains as the dollar and Treasury yields fell after a rally that followed a strong US jobs report on Friday.

- Spot gold was down slightly at $1,783 an ounce, while gold futures held around $1,801. Uncertainty over upcoming U.S. CPI inflation data drove the dollar lower and the acquisition of yellow metal as a safe haven.

-----------------------------------------

Commodities: Oil

- Oil prices pulled back slightly on the latest progress in last-ditch talks to revive the 2015 Iran nuclear accord, which would clear the way to boost its crude exports in a tight market.

- Brent crude futures fell 14 cents, or 0.1%, to $96.51 a barrel, paring a 1.8% gain from the previous session. U.S. West Texas Intermediate (WTI) crude futures declined 16 cents, or 0.2%, to $90.60 a barrel, after climbing 2% in the previous session.

ــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــ

For more articles click here