How do markets move ahead of Powell's speech in Jackson Hole?

Markets continue to calibrate for the Federal Reserve Chair Jerome Powell’s keynote at the Jackson Hole symposium.

- It looks like the Fed may manage a “soft landing” for its own economy, but the prospects for Europe are far more worrying.

- Much of the world is facing the fastest price growth since the early 1980s, raising fears that the wage-price spiral of that era, which required double-digit interest rates – and painful recessions – to restore price stability, could repeat itself.

- Many of the central bankers are heading to Jackson Hole symposium, hoping that today’s inflationary pressures will subside fast enough to allow them to offset the expected downturns in economies around the world.

Equities:

- In Wall Street, US stocks are in a bear market rally. The Dow Jones fell following its worst day since June as investors braced for a hawkish message from the Federal Reserve. Healthcare, real estate and utilities were the worst performers in the S&P 500. Meanwhile, energy was the biggest winner in the broader market index, up 4% on the back of rising oil prices. Zoom Video shares slumped 13% after the video conferencing company lowered its full-year forecast.

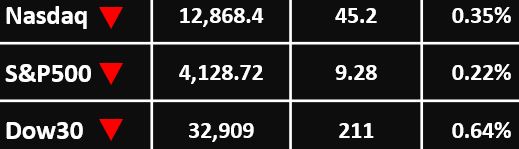

- The Dow Jones Industrial Index fell 211 points, or 0.64% to 32,909 points. The S&P 500 index fell 9.28 points or 0.22% to 4,128.72 points, and the Nasdaq Composite Index fell 45.2 points or 0.35% to 12,868.4 points.

---------------------------------------------------

Currency Market:

- The U.S. dollar edged higher after more hawkish Fed comments, while the euro continued to languish below parity. The Dollar Index traded 0.1% higher to 108.623.

- EUR/USD fell 0.2% to 0.9952, with the euro having fallen more than 12% against the dollar this year. GBP/USD dropped 0.1% to 1.1817, after the latest U.K. PMI data showed a slowdown in economic activity.

- USD/JPY edged higher to 136.81, while USD/CNY rose 0.4% to 6.8641 coming close to a two-year high as reports of potential power cuts in industrial hub Shanghai weighed on the yuan. AUD/USD stands in the 0.6920 region.

---------------------------------------------------

Commodities: Gold

- Gold prices held recent gains as the dollar retreated slightly on weak economic data, with focus now turning to commentary from the Federal Reserve on the path of interest rates.

- Gold futures fell 0.1% to $1,759.25 an ounce, while spot gold fell 0.1% to $1,744.01 an ounce.

---------------------------------------------------

Commodities: Oil

- Oil prices were little changed as the market grappled with supply concerns amid the sanctioning of Russian shipments and the initial shock of comments that major producers would cut output wore off.

- Brent crude futures were down 6 cents, or 0.06%, to $100.16 a barrel. WTI crude were up 9 cents, or 0.1%, at $93.83 a barrel.

---------------------------------------------------

For more articles click here